04

CardCheck — Instantly Verify Credit Card Numbers

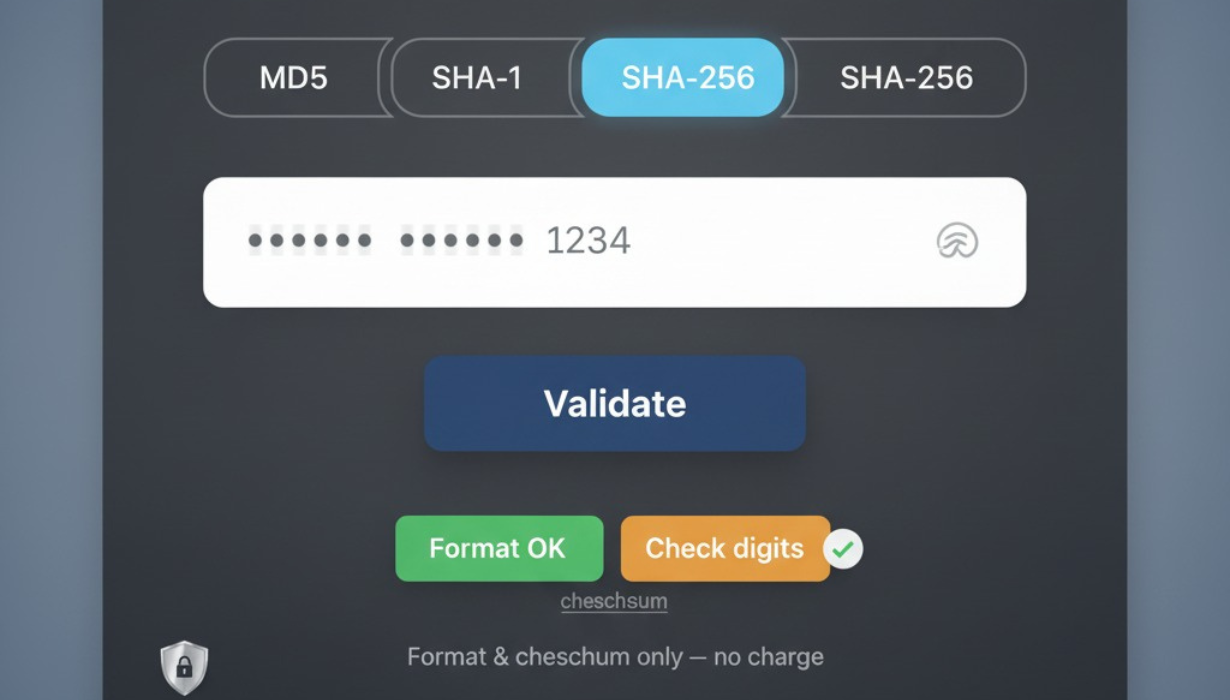

Validate credit card numbers instantly with CardCheck. Check format and checksum to reduce typos and failed payments while protecting customer data.

CardCheck is a fast, simple way to confirm that a credit card number is written correctly before it reaches your payment system. Paste or type a number, run the check, and get a clear result that helps you catch typos, wrong lengths, or invalid patterns early. It’s a small step that prevents failed payments, saves support time, and makes checkout smoother for everyone.

What CardCheck Actually Does

CardCheck validates the structure of a card number and confirms that it passes a standard checksum test used across major networks. In plain language, it tells you whether the number is formatted like a real card number and whether the digits add up correctly. It does not charge cards, verify available funds, or tell you whether an account is open. Think of it as a spell-check for card numbers: handy for catching mistakes, not a substitute for your payment gateway.

Why Format Validation Matters

A single mistyped digit can derail a checkout, increase cart abandonment, and generate unnecessary support tickets. Format validation catches those mistakes before a transaction is attempted, which means fewer declines, fewer charge attempts on gateways, and less frustration for customers. For teams that rely on invoices, subscriptions, or one-time purchases, this quick check improves success rates and keeps operations running smoothly.

Who Benefits Most From CardCheck

E-commerce stores and SaaS apps that want cleaner checkouts and fewer declines

Finance and billing teams handling invoices and subscription updates

Customer support agents who collect card details by phone and need to confirm input accuracy

Developers and QA testers building or reviewing payment forms

Operations teams doing data hygiene, form audits, or bulk input reviews

What CardCheck Checks For

Checksum validity to ensure the digits are arranged correctly

Basic pattern consistency to flag clearly malformed numbers

Optional spacing hints so numbers display in a readable, consistent way on forms

Privacy, Security, and Responsible Use

Card numbers are sensitive. Use CardCheck responsibly and only when you have a legitimate reason and the cardholder’s consent. Do not store full card numbers in logs, tickets, screenshots, or chat transcripts. If your workflow requires ongoing storage, use tokenization from a PCI-compliant payment provider and never keep raw card data on your servers. CardCheck is a formatting and checksum helper; it is not a replacement for PCI compliance, encryption, or your payment gateway’s fraud controls.

Best Practices for Safer Workflows

Prefer hosted, PCI-compliant fields from your payment processor so raw numbers never touch your servers

Mask input in interfaces so full numbers aren’t visible to bystanders or recorded by screen captures

Limit exposure by showing only the last four digits after submission

Avoid emailing or messaging full card numbers; use secure forms and tokenized updates

Clear clipboard data after use on shared machines and disable verbose logging on payment pages

How To Use CardCheck In Under A Minute

Enter the card number exactly as provided

Run the validation to check length, pattern, and checksum

If the result is invalid, re-read the digits and correct obvious typos

Proceed to your payment processor once the number passes the format check

Practical Ways CardCheck Reduces Friction

Checkout pages can validate input before a user presses pay, preventing instant declines

Support desks can confirm accuracy during address or card updates and reduce follow-up calls

Finance teams can spot input errors on recurring billing updates before the cycle runs

QA can verify that staging forms handle spacing, masking, and error states predictably

Training materials can include a reminder to validate numbers first to avoid rework

Clean UX Tips For Payment Forms

Use clear, readable input with automatic spacing to reduce entry mistakes

Provide immediate, friendly feedback if the number looks incorrect

Offer inline guidance for expiration date and security code so users finish on the first try

Keep error messages simple and specific without revealing sensitive logic

Place the pay or save button only after the form confirms valid formatting

Common Mistakes And How To Avoid Them

Relying solely on the gateway to catch typos increases failed attempts; validate early

Logging full card numbers for debugging creates long-term risk; sanitize logs

Storing full PANs in spreadsheets or CRMs breaks compliance; store tokens and last four digits only

Treating format validity as proof a card will work confuses teams; emphasize that validation is not authorization

FAQ

Does CardCheck verify funds or account status

No. It only confirms formatting and checksum validity. Authorization and fraud checks happen with your payment provider.

Is it safe to use CardCheck with real customer numbers

Only if you have a legitimate purpose, consent, and proper security measures. Avoid storing or sharing full numbers. Prefer tokenized workflows.

Why did a number pass here but fail at the gateway

Gateways perform additional checks such as issuer responses, card status, fraud filters, and address verification. Format validity is just the first step.

Should we store the validation result

You can store a boolean like “passed format check” but do not store the full number. Keep only tokens and the last four digits when necessary.

Can CardCheck detect stolen or fake cards

No. Valid format does not equal legitimate use. Always rely on your payment processor’s risk controls and your own anti-fraud processes.

SEO Tips For Your CardCheck Page

Add concise H2s that mirror common searches like “credit card number validator” and “Luhn check”

Write meaningful alt text for your hero image that references card number validation

Link to related tools such as Online SMTP Test (for transactional email reliability) and MailCheck (for email address accuracy)

Keep paragraphs short and scannable so users find answers quickly

Accessibility And Inclusion

Label inputs clearly and announce errors with accessible messages

Ensure color is not the only indicator of validity; include icons or text feedback

Support keyboard navigation and screen readers on every field

Provide simple, respectful language in error states to reduce confusion and stress

Simple Implementation Checklist For Teams

Validate format and checksum before attempting a charge

Mask the number after submission and never reveal full digits in the UI

Tokenize with your gateway and store only tokens plus last four digits

Audit logs and analytics to confirm full numbers are never recorded

Document who can access payment settings and review that list quarterly

Hero Image Description (Alt Text Idea)

A clean CardCheck interface on a soft blue gradient shows a masked card input with auto-spacing, a subtle network icon, a Validate button, and a result line that toggles between a green “Format OK” badge and a clear “Check digits” hint; a small note reads “Validation checks format and checksum only,” conveying trust, clarity, and safe handling.

Final Takeaway

CardCheck prevents simple mistakes from becoming failed payments. By validating structure and checksum before you reach the gateway, you reduce declines, speed up support, and give customers a smoother experience. Pair this quick check with tokenization, masking, and your provider’s security features, and you’ll have a payment flow that feels easy for users and safer for your business.

Contact

Missing something?

Feel free to request missing tools or give some feedback using our contact form.

Contact Us